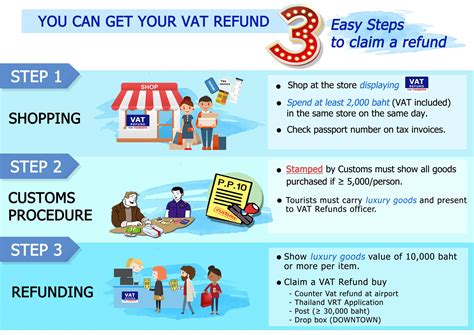

goyard vat refund | Goyard singapore goyard vat refund Interestingly, not every brand provides the same percent refund. In our travels, the Hermes VAT refund is 10% while Chanel and Goyard gave 12%. How to Get a VAT Refund? There are two main methods of getting your VAT .

$19.99

0 · where to get a vat refund

1 · stores with no vat refund

2 · how much is vat refunded

3 · high end stores with vat refund

4 · Goyard singapore price list

5 · Goyard singapore

6 · Goyard price list

7 · Goyard bags price list

The book reflects this focus. Peter explores a piece of doctrine, and then encourages the Christians to apply it to their lives. He makes four of these back-and-forth cycles: Peter begins his letter by calling Christians “aliens,” or residential foreigners to the Roman Empire ( 1 Pe 1:1, 17 ).

So, my total VAT refund now only comes out to 16,562 JPY (~2.79 USD). Of course, you don’t get your VAT refund right away either. It takes a couple of days for it to be credited back to your credit card. The VAT refund in Paris is usually around 12% (technically 10-11%) so you will actually be saving even more than what I’ve posted. Depending on the state you live in, you . Singapore Goyard VAT Refund. When I asked the sales associate at the Goyard store what the VAT refund was, she said about 6% after all Global Blue’s fees (the company that Goyard uses for VAT refunds).I just made a ~k purchase at Goyard in Milan and stumbled across a post explaining that 3rd party VAT companies take a pretty big cut out of the total VAT, but that it is possible to submit .

Only visitors—including U.S. tourists—are able to qualify for a VAT refund. Keep in mind, VAT is often factored into the price of a product (so a €100 dress with a 20 percent VAT rate might have a price tag of €120). Other times, . Interestingly, not every brand provides the same percent refund. In our travels, the Hermes VAT refund is 10% while Chanel and Goyard gave 12%. How to Get a VAT Refund? There are two main methods of getting your VAT .

With the 12% VAT refund of €146.4, that brings the cost to €1073.6. At a conversion rate of 1.05 (about what it was at the time) – in U.S. dollars that’s now 26. In other words, there’s a saving of about 0, just .On 8 December 2022, the EU Commission presented the "VAT in the digital age" package, which consists of three proposals: A proposal for a Council directive amending directive 2006/112/EC .

where to get a vat refund

November 8, 2024. Senate Bill No. 2415, which would allow nonresident tourists to apply for value added tax (VAT) refunds, was approved by the Senate on September 23, . All you have to know is how to do it. The rules for who gets a VAT refund, procedures for how to get your money back and the amount the final refund will be vary widely depending on location, and navigating the process can . So, my total VAT refund now only comes out to 16,562 JPY (~2.79 USD). Of course, you don’t get your VAT refund right away either. It takes a couple of days for it to be credited back to your credit card.

The VAT refund in Paris is usually around 12% (technically 10-11%) so you will actually be saving even more than what I’ve posted. Depending on the state you live in, you will be saving on taxes as well since you don’t have to pay those if you buy your Goyard in Paris.

Singapore Goyard VAT Refund. When I asked the sales associate at the Goyard store what the VAT refund was, she said about 6% after all Global Blue’s fees (the company that Goyard uses for VAT refunds). I just made a ~k purchase at Goyard in Milan and stumbled across a post explaining that 3rd party VAT companies take a pretty big cut out of the total VAT, but that it is possible to submit documents independently (not through GlobalBlue or PlanetTaxFree) to get the full VAT refund. Only visitors—including U.S. tourists—are able to qualify for a VAT refund. Keep in mind, VAT is often factored into the price of a product (so a €100 dress with a 20 percent VAT rate might have a price tag of €120). Other times, it is listed on the receipt. Interestingly, not every brand provides the same percent refund. In our travels, the Hermes VAT refund is 10% while Chanel and Goyard gave 12%. How to Get a VAT Refund? There are two main methods of getting your VAT refund. Use the Store’s Refund Affiliate: VAT-free shopping stores often post signs indicating tax free shopping (like duty-free .

With the 12% VAT refund of €146.4, that brings the cost to €1073.6. At a conversion rate of 1.05 (about what it was at the time) – in U.S. dollars that’s now 26. In other words, there’s a saving of about 0, just by purchasing in Paris.On 8 December 2022, the EU Commission presented the "VAT in the digital age" package, which consists of three proposals: A proposal for a Council directive amending directive 2006/112/EC as regards VAT rules for the digital age. A proposal for a Council regulation amending regulation (EU) No 904/2010 as regards the VAT administrative . November 8, 2024. Senate Bill No. 2415, which would allow nonresident tourists to apply for value added tax (VAT) refunds, was approved by the Senate on September 23, 2024. Under the law, a tourist would be eligible for a VAT refund on locally purchased goods, which may be made either electronically or in cash, provided that the following .

All you have to know is how to do it. The rules for who gets a VAT refund, procedures for how to get your money back and the amount the final refund will be vary widely depending on location, and navigating the process can . So, my total VAT refund now only comes out to 16,562 JPY (~2.79 USD). Of course, you don’t get your VAT refund right away either. It takes a couple of days for it to be credited back to your credit card. The VAT refund in Paris is usually around 12% (technically 10-11%) so you will actually be saving even more than what I’ve posted. Depending on the state you live in, you will be saving on taxes as well since you don’t have to pay those if you buy your Goyard in Paris.

Singapore Goyard VAT Refund. When I asked the sales associate at the Goyard store what the VAT refund was, she said about 6% after all Global Blue’s fees (the company that Goyard uses for VAT refunds).

I just made a ~k purchase at Goyard in Milan and stumbled across a post explaining that 3rd party VAT companies take a pretty big cut out of the total VAT, but that it is possible to submit documents independently (not through GlobalBlue or PlanetTaxFree) to get the full VAT refund.

Only visitors—including U.S. tourists—are able to qualify for a VAT refund. Keep in mind, VAT is often factored into the price of a product (so a €100 dress with a 20 percent VAT rate might have a price tag of €120). Other times, it is listed on the receipt. Interestingly, not every brand provides the same percent refund. In our travels, the Hermes VAT refund is 10% while Chanel and Goyard gave 12%. How to Get a VAT Refund? There are two main methods of getting your VAT refund. Use the Store’s Refund Affiliate: VAT-free shopping stores often post signs indicating tax free shopping (like duty-free . With the 12% VAT refund of €146.4, that brings the cost to €1073.6. At a conversion rate of 1.05 (about what it was at the time) – in U.S. dollars that’s now 26. In other words, there’s a saving of about 0, just by purchasing in Paris.

On 8 December 2022, the EU Commission presented the "VAT in the digital age" package, which consists of three proposals: A proposal for a Council directive amending directive 2006/112/EC as regards VAT rules for the digital age. A proposal for a Council regulation amending regulation (EU) No 904/2010 as regards the VAT administrative .

stores with no vat refund

michael kors signature raven large tote

how much is vat refunded

Découvrez Malte en une semaine grâce à notre itinéraire de 7 jours. Plages de rêve, patrimoine historique et culturel au programme !

goyard vat refund|Goyard singapore